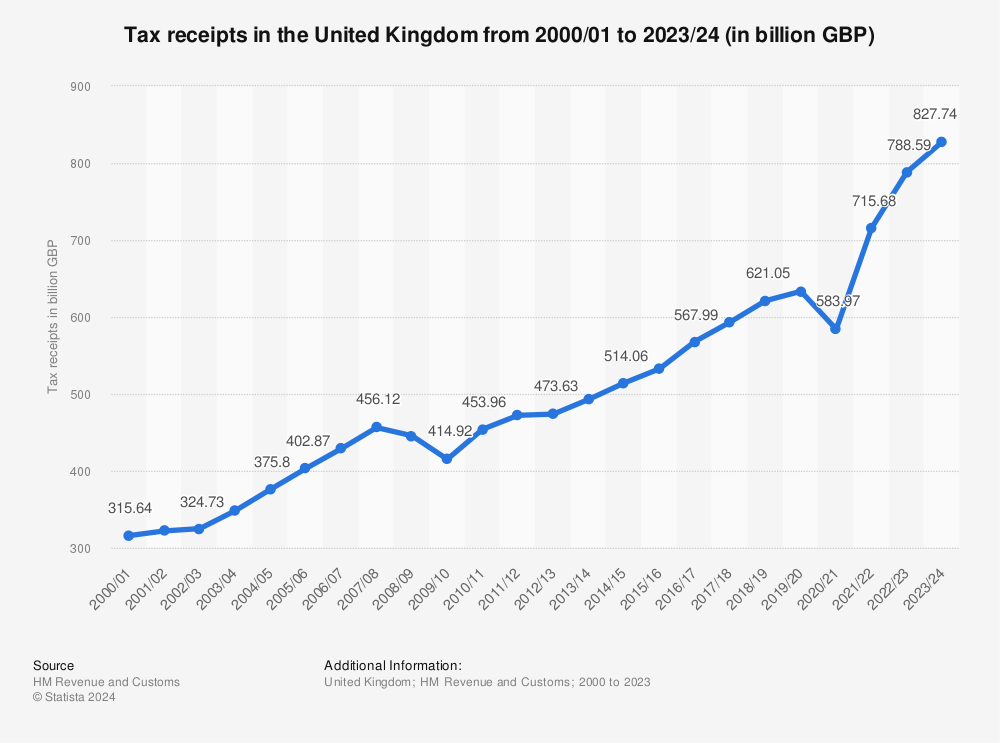

april 2016 service tax rate

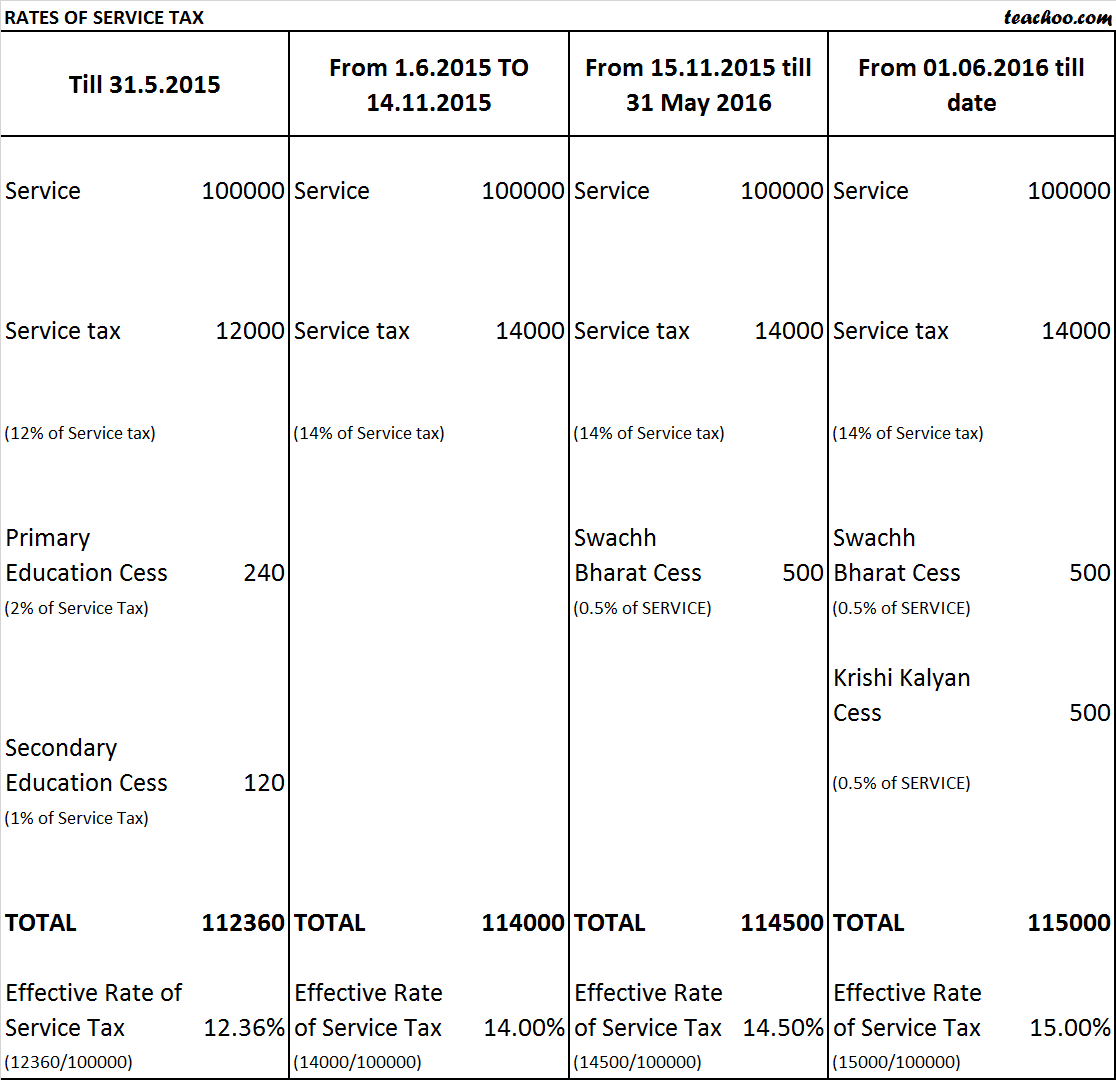

An illustration showing levy of Service tax and SB Cess KKC is given below assuming Rs. Till 31 May 2016 the Service Tax rate was 145.

262012 ST ABATEMENT NOTIFICATION OF SERVICE TAX BY NOTIFICATION NO 82016 DT 1ST MAR 2016.

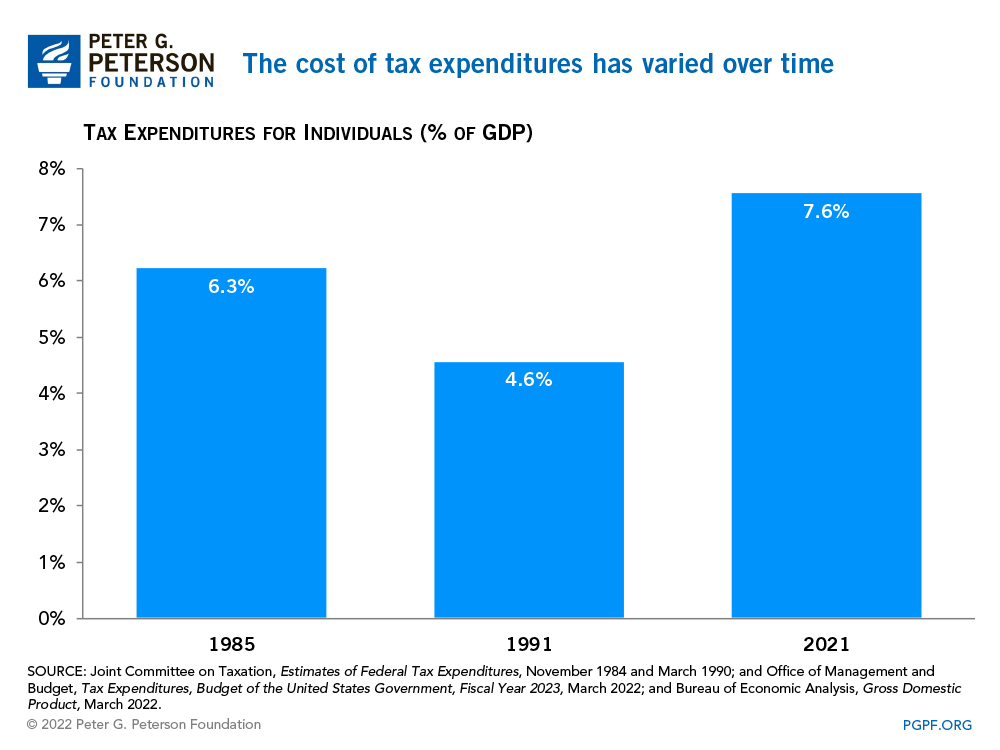

. This Cess would be applicable from 1st June 2016. What is the Rate of Service Tax for 2015-16 and 2016-17 Last updated at Nov. However taxable income over certain levels was subject to a 33-percent tax rate to phase out the benefit of the 15-percent tax bracket as compared to the 28-percent rate and the deduction for personal exemptions.

12 Basic Rate 2EC on 12 1SHEC on 12 Illustration. In above chart replace 15 with 145 in above chart to calculate old rate. Accordingly the rate of ST shall be 15 wef.

Tax Rates 2016 1 For Tax Years 1988 through 1990 the tax rate schedules provided only two basic rates. Simple Interest Rate 12 Proviso to Section 75 and NOTIFICATION NO132016-ST DATED 1-3-2016. Earlier till 31st May 2015 the service tax rate was 1236.

Concession of 3 will be available thus making the effective rates as 15 21 and 27 pa. However if assessee has collected service tax but did not deposit it with Government interest rate will be 24 Notification No. Service tax rate increased from 145 to 15 increase by way of levying Krishi Kalyan Cess at 05.

12 was the basic rate 2 was Education Cess and 1 was Secondary and Higher Education Cess. From 15112015 Krishi Kalyan Cess -05 wef from 01062016. The Internal Revenue Service IRS is responsible for publishing the latest Tax Tables each year rates are typically published in 4 th quarter of the year proceeding the new tax year.

The Said change will be effective from 1st June 2016. February 18 2016 In exercise of the powers conferred by section 109 of the Finance Act 2015 No. Thus effective rate of Service Tax as of now is 1236.

Any other changes in service tax rate w e f 1st April 2016. On the value of such services for the purposes of financing and promoting initiatives to improve agriculture or for any other. Service tax abatement rate wef 01042016 after budget 2016 0 0 RAJ KUMARI Saturday March 5 2016 Edit this post CHANGES MADE IN NOTIFICATION NO.

From 1st June 2016 onward the new rate of service tax is 15 due to the introduction of Krishi kalyan Cess 05. For detail article about service tax changes applicable from 1416 read here. This page provides detail of the Federal Tax Tables for 2016 has links to historic Federal Tax Tables which are used within the 2016 Federal Tax Calculator and has supporting links to each set of state.

Service Tax Basic Rate -14 Swachh Bharat Cess 05 wef. Changes in Service Tax by Union Budget 2016-17 Finance Act 2016 The above changes shall have impact on the levy of existing 1450 and revised ST rate 15 on the continuing works as well as on works completed but not billed. Full information on Krishi Kalyan Cess and its applicablility.

Before 1st June 2016 only Service Tax 14 and Swachh Bharat Cess 05 would be applicable but from 1st June 2016 Krishi Kalyan Cess would also be applicable and then the effective rate of tax would become 15. 01-06-2016 from existing effective rate of 1450. All about Krishi.

Service Tax Late Payment Interest Rate from 14052016 Interest payable for delayed payment of Service Tax is 15. 2 there shall be levied and collected in accordance with the provisions of this chapter a cess to be called the krishi kalyan cess as service tax on all or any of the taxable services at the rate of 05 per cent. With Krishi Kalyan cess the service tax would increase to 15.

20 of 2015 the Central Government hereby appoints the 1st day of April 2016 as the date on which the provisions of sub-section 1 of section 109 of the said Act shall come into effect. Changes applicable from 1st April 2016. In addition to the basic rate of 12 Education Cess at the rate of 2 and Secondary and Higher Secondary education Cess at the rate of 1 are levied on service tax rate in respect of all taxable services.

How the increase in Service Tax affected Various Services. 15 percent and 28 percent. Service Tax Basic Rate -14 Swachh Bharat Cess 05 wef.

Cenvat credit of input services are now available. The increase in Service Tax affected some services in the following way. 14052003 09092004 8.

Interest rates on delayed payment of dutytax across all indirect taxes is proposed to be made uniform at 15 except in case of service tax collected but not deposited with the Central Government in which case the rate of interest will be 24 from the date on which the service tax payment became due. 1000- as value of a taxable service. 132016-ST dated 1-3-2016 effective from 14th May 2016.

New Service Tax Chart with Service Tax Rate of 15 Service tax rate increased from 145 to 15 increase by way of levying Krishi Kalyan Cess at 05. While Swachh Bharat Cess was levied to conduct cleanliness drive in India the new cess has been levied for the purpose of financing and promoting initiatives to improve agricultural growth. B-1102015 TRU K Kalimuthu.

For the tax payers with value of taxable service less than 60 lakh rupees in PFY interest rate for delayed payment will be 12. The rate of Service Tax was increased from 1236 to an all inclusive flat 14 which included Subsuming Education Cess and Secondary Higher Secondary Education Cess. Before 1st June it is 145.

Service tax rate 145 is applicable for period during 142016 to 3152016. From 15112015 Krishi Kalyan Cess -05 wef from 01062016 Total Service Tax Rate 15. Refer point of taxation article for further clarification.

262012-ST dated June 20 2012 as amended. Service Tax Interest Rates on delayed payment of Service Tax in case of assessees whose value of taxable services in the preceding yearyears covered by the notice is less than Rs60 Lakh. 10 2016 by Teachoo Service Tax Rates have changed from time to time as shown below BREAKUP OF DIFFERENT TAX AND CESS Note- Primary and Secondary Education Cess was charged on Tax Swachh Bharat Cess and Krishi Kalyan Cess were charged on Amount.

The Said change will be effective from 1st June 2016. Effective rates under the Abatement Notification No. Any other changes in service tax rate w e f 1st April 2016.

From 142016 service tax is leviable on 30 on amount charged for service of transport of passengers by rail without availability of cenvat credit of inputs and capital goods. After levy of KKC Service tax rate would increase from 145 to 15 effective from June 1 2016.

If Petrol And Diesel Are Brought Under Gst They Ll Have To Be Taxed At More Than 100 Mint

Tax Principles Relx Information Based Analytics And Decision Tools

What Is The Rate Of Service Tax For 2015 16 And 2016 17

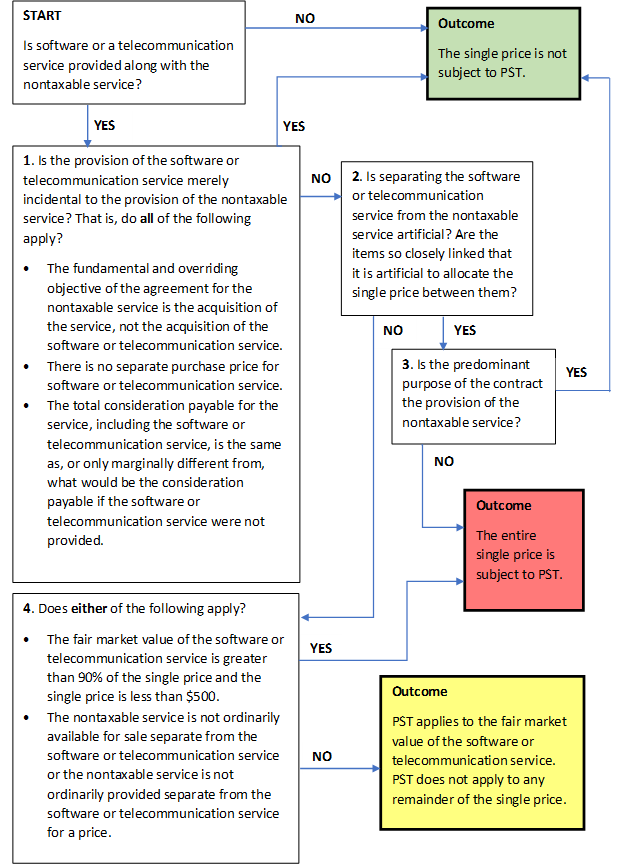

Tax Interpretation Manual Provincial Sales Tax Act General Rulings Province Of British Columbia

Taxtips Ca Business 2020 Corporate Income Tax Rates

Tax Rate An Overview Sciencedirect Topics

Gst Rates 2020 Complete List Of Goods And Services Tax Slabs

Tax Principles Relx Information Based Analytics And Decision Tools

Interaction Of Household Income Consumption And Wealth Statistics On Taxation Statistics Explained

Image Result For Gst In Other Countries List List Of Countries Country Other Countries

Fact Check Viral Post Exaggerates Tax Rates Under Eisenhower

2016 Tax Bracket Rates Bankrate Com

/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

Types Of Taxes Income Property Goods Services Federal State

Canada S 2022 Federal Budget Select Tax Measures Knowledge Fasken

How Do Marginal Income Tax Rates Work And What If We Increased Them

Point In Time Connection City Of Hamilton Ontario Canada

The Impact Of Gst On Varied Business Areas Gst Gstbill Business Tax Goods And Service Tax Business Challenge